“Christina, are you sure buying a car and getting a new apartment with your refund check is the best decision?”

“Yes,” she replied, “I mean, it’s not like I’m not going to pay back when I finally graduate and get a better paying job.”

Christina, a junior at West Chester University, who lives 15 minutes away from campus, received a refund check of $6000. With that $6000 she decided she no longer wanted to ride the bus and wanted not only a car but an apartment as well. As I listened to her, I tried to reason with her and warn her $6000 can only get you so far and that other expenses could get in the way.

Although Christina, like most students, has a part-time job, I predicted that it would be hard enough to pay for the car plus any maintenance and insurance, let alone any other monthly expenses. She replied that her plan is to request an increase in her loan every semester, in order to afford her new expenses. Although there are some students who can do this and are able to balance their loans with their reasonable expenses. However, it is possible to not rely on increasing your loans and this is done by simply managing your money.

College is where a young adult starts to take their first steps into adulthood. For many students, like Christina, college is where you get the first taste of independence, a place where you learn and grow, and start making your own decisions. Most of these decisions will be based on money. The choice to stay money smart when others choose to squander money is a key difference between college students. To Christina, financial responsibility may seem like a trivial issue, something that shouldn’t be considered yet. Not because she doesn’t necessarily have to consider it, but because she feels real life begins when you graduate and find a job.

However, while some may not consider now to be a good time to start managing money, it could be an essential habit to form for later in life. Therefore, to avoid a shaky foundation of money issues here are some tips I use in order to manage my financials while still being a college student:

1. Budget your money

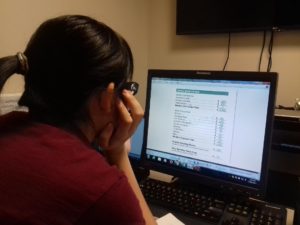

Tailor your income to your needs, and learn to do away with the unreasonable expenses. Ask yourself if this purchase is a want or a need. Put some of your computer skills to use and budget your monthly expenses on a spreadsheet. You are less likely to squander your money when you can visibly compare your income to your expenses. Include in your budget things like food, transportation, textbooks, bills, and other important needs. After this you can get a good look at how much you have left, need to save, and what can be spent on fun activities.

2. Cut your expenses

Cutting your expenses means having leftover money that can be saved in a backup fund. Budgeting your monthly expenses allows you to tell what exactly needs to be slashed from your spending habits. If it’s buying new textbooks that aren’t used after a semester, try renting your books, buying used books, or sharing a book with a classmate. Having trouble eating out too much? Try to cook your own meals. Or if it’s the number of costly activities you do, check the student activities calendar for free fun things you can do with your friends.

3. Leftovers

No, I don’t mean leftover food. Leftover money is essential as that’s how you can start saving money month to month. Although, you may not think you need to be saving as much right now, saving serves as a reserve in case of emergency. Furthermore, learning to save while you earn little may pay off when you start earning the big bucks. By then you’ll be used to spending within your means and may end up saving the majority

4. Change your mindset

I, like Christina, used to think financial aid is free money, however, learned this is not the case. Financial aid is by no means free, and if not paid as promised, it could end up damaging your credit. Tori Weigant, the Assistant Director of Financial Aid at West Chester University believes that “before you try to use your loan money for anything else, you should look at how much it’s costing you because your interest increases every day.”

You may be fortunate to use your parent’s credit for everything now, but it won’t last forever. A bad credit may result in difficulty purchasing a car, a house, and starting your own business. Refund money can be used as a back up fund, go toward your debt, or be saved for something else. So, manage your money in college by using your refund check wisely.

5. Get Busy

Participate in student organizations, go to the gym, get a job or two if you must. The point is, by keeping yourself busy with positive, productive activities it leaves little time for spontaneous spending.

Budgeting, saving, cutting down expenses, changing your mindset, and getting busy may seem hard, depending on your level of income and how much you care about your long-term goals, but it’s worth giving it a shot. College is the foundation for many long-term decisions, and the choice to stay money smart now will pay off in the long run.

What to read next: Ken Ayres moved to a permanent position from an internship